Corona Virus Aid, Relief and Economic Security Act, also referred to as “CARES Act” was passed on March 27th, 2020. What does this mean for you as a business owner or as an employee? The bill was passed in order to provide support to individuals, small businesses, corporations, hospitals, state and local governments and education.

The CARES Act allows businesses to apply for loans (Paycheck Protection Program) that will allow them to continue paying employees and maintain operations. It is important to to acknowledge that this loan may be forgiven.

The bill also expands on provisions of the Families First Coronavirus Act (FFCRA), and provides for additional flexibility regarding unemployment insurance, among other aid and relief for employers.

Paycheck Protection Program

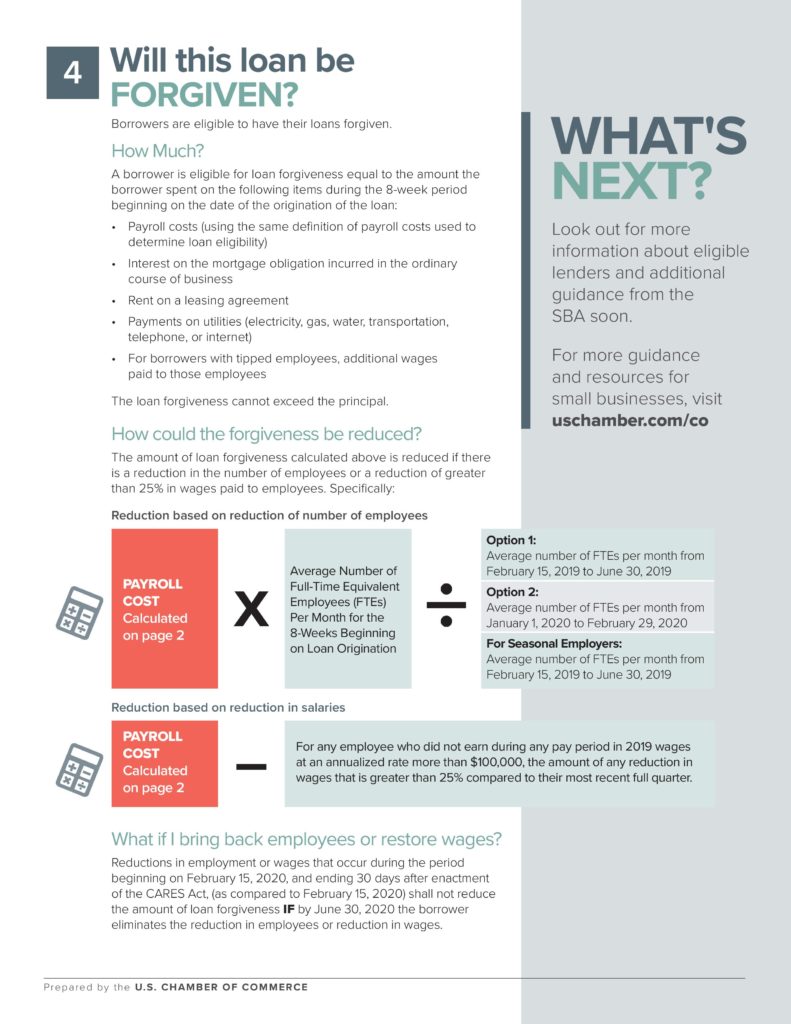

The CARES Act allocated $350 billion to help small businesses keep their workers employed throughout this unprecedented time. The Paycheck Protection Program’s initiative is to provide 100% federally guaranteed loans to small businesses. Most importantly, these loans MAY BE FORGIVEN if the borrowers are able to maintain their payrolls during the crisis or if they are able to restore their payrolls afterward.

The Small Business Administration will soon release more details including the list of lenders offering loans under the program. However in the meantime here is a simplified guide you to prepare to file the loan. Information for this guide was pulled from the U.S. Chamber of Commerce.

Are you eligible?

You are eligible if you are:

• A small business with fewer than 500 employees

• A small business that otherwise meets the SBA’s size standard

• A 501(c)(3) with fewer than 500 employees

• An individual who operates as a sole proprietor

• An individual who operates as an independent contractor

• An individual who is self-employed who regularly carries on any

trade or business

• A Tribal business concern that meets the SBA size standard

• A 501(c)(19) Veterans Organization that meets the SBA size standard

In addition, some special rules may make you eligible:

• If you are in the accommodation and food services sector (NAICS 72),

the 500-employee rule is applied on a per physical location basis

• If you are operating as a franchise or receive financial assistance

from an approved Small Business Investment Company the normal

affiliation rules do not apply

REMEMBER: The 500-employee threshold includes all employees:

full-time, part-time, and any other status.

What will lenders be looking for?

Borrowers will need to complete the Paycheck Protection Loan Application (which is available here) and payroll documentation

Lenders will also ask you for a good faith certification that:

- The uncertainty of current economic conditions makes the loan request necessary to support ongoing operations

- The borrower will use the loan proceeds to retain workers and maintain payroll or make mortgage, lease, and utility payments

- Borrower does not have an application pending for a loan duplicative of the purpose and amounts applied for here

- From Feb. 15, 2020 to Dec. 31, 2020, the borrower has not received a loan duplicative of the purpose and amounts applied for here (Note: There is an opportunity to fold emergency loans made between Jan. 31, 2020 and the date this loan program becomes available into a new loan)

If you are an independent contractor, sole proprietor, or self-employed

individual, lenders will also be looking for certain documents

(final requirements will be announced by the government) such as

payroll tax filings, Forms 1099-MISC, and income and expenses from

the sole proprietorship.

Provisions for Employers

Deferral of payments for Social Security Tax:

It is important to remember that this is NOT a payroll tax holiday and that you will still owe tax just on a later time.

It is optional whether or not you would want to defer the employer share of Social Security Tax.

Employer Social Security Tax is paid at a rate of 6.2% of the first 137,700 in wages for each employee.

This option is available to any employer regardless of size. If you have payroll tax deposits due March 27 – December 31, 2020 and do defer then:

- 50% due 12/31/2020

- Remainder due by 12/31/2020

Employee retention credit:

The employee retention credit was put into place to encourage employers to keep workers on payroll. Eligible employers can receive a payroll credit against employment taxes.

To be Eligible:

- Must have been operating in 2020

- Business operations must have been suspended to meet a COVID-19 requirement. (Ex. Shelter in place order)

-

-

-

- This can include partial suspension such as restaurants only open for take-out and no longer offer dine-in

-

-

-

- OR the business sustained a significant decline in gross receipts compared to the same quarter of the prior year.

Qualifying Wages:

- Employers with 100+, can only be taken against wages paid when the employee is not working, furloughed employees but still paying them

- 100 or fewer employees this wage can be applied against any employee wages

- Employer’s contribution to health plans are included

Applying the Credit:

It applies to company total of employer FICA. To credits available under First Corona Relief Act and reduction may be allowed against all federal liabilities.

Expansion of Unemployment Insurance Benefits

Individuals & Employees

The CARES Act went on to expand the unemployment insurance benefits by making changes to eligibility to expand the scope of the population who can qualify to individuals who are self-employed, gig workers and workers furloughed due to COVID-19.

It also increases benefits to a MAX benefit amount by $600 per week. This is over and above the state benefit and will apply until July 31, 2020.

The time period for the additional covered workers is January 27 – December 31, 2020. The total benefit period per worker is limited to 39 weeks. Additional weekly benefit of $600 will only be available until July 31, 2020.

State Administration

- Benefits are administered by each state

- States must agree to provide these benefits

- States will be reimbursed by the Department of Labor

- States may choose to waive waiting periods involved in receiving unemployment.

Information in this blog was provided by HR Wise HR Professionals, Paylocity Webinar & US Chamber of Commerce.